Pakistan

Pakistan loses Rs1 trillion annually due to tax evasion, illicit trade – Pakistan Observer

Pakistan

Sapphire Fibres, Mindbridge’s joint acquisition of Uch Power approved – Pakistan Observer

Pakistan

Electricity tariff cut on the horizon as contracts ended with five IPPs

Pakistan

Different sectors involved in sales tax evasion worth Rs3.4 trillion: Aurangzeb

Pakistan

Virtual University, Bank Alfalah Ltd. sign IPG, Payroll agreements – Pakistan Observer

-

Technology7 مہینے ago

Technology7 مہینے agoSamsung’s new midrange Galaxy A55 has improved security, features | The Express Tribune

-

Pakistan7 مہینے ago

Pakistan7 مہینے agoNew Zealand in efforts to fast track consenting of major projects – Pakistan Observer

-

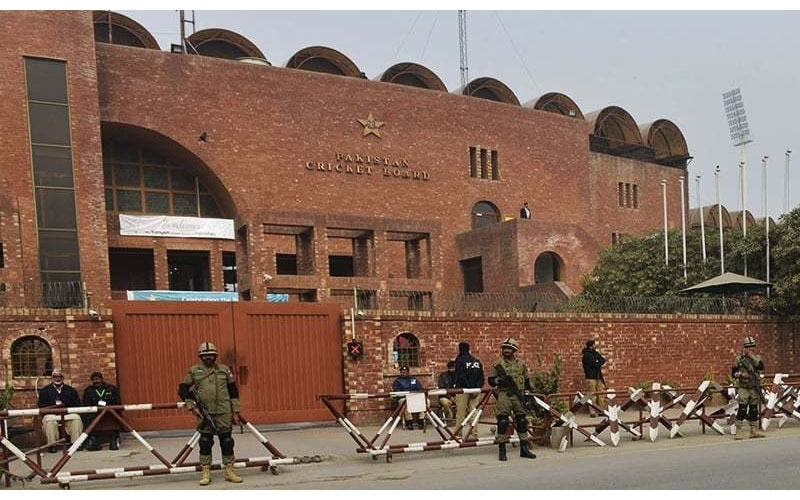

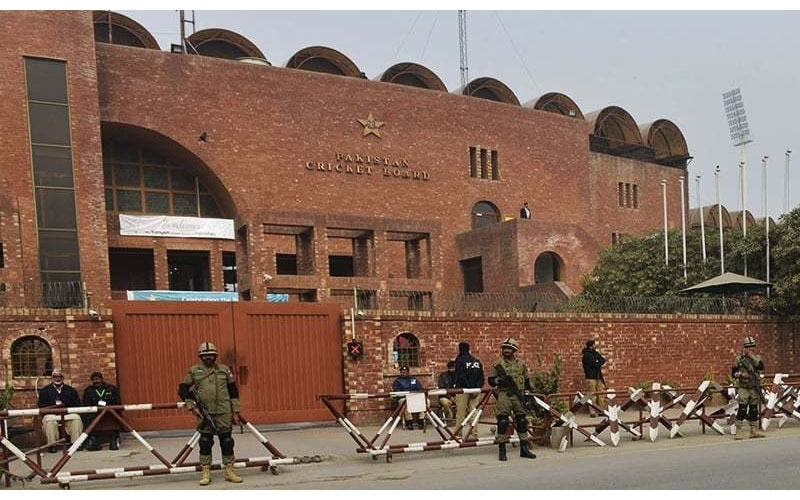

Sports6 مہینے ago

Sports6 مہینے agoPCB opens applications for specialized red and white-ball coaches

-

Sports7 مہینے ago

Sports7 مہینے agoUSA pacer eyes face-off with Virat Kohli, Babar Azam at 2024 T20 World Cup

-

Entertainment7 مہینے ago

Entertainment7 مہینے agoPrince William foils Prince Harry’s reunion plans ahead of UK return

-

Pakistan6 مہینے ago

Pakistan6 مہینے agoToday Chicken Rate in Lahore – April 2024 – Pakistan Observer

-

Pakistan7 مہینے ago

Pakistan7 مہینے agoLegal issues hinder projects’ transfer | The Express Tribune

-

Sports6 مہینے ago

Sports6 مہینے agoConversation continues between PCB, New Zealand for white ball series